The term Robotics-as-a-Service (RaaS) has become a cornerstone of the robotics industry, yet its definition remains narrow and has become outdated. Traditionally, RaaS is defined as a subscription-based model where customers pay for robotic services rather than purchasing hardware outright. The RaaS company retains ownership of the robotic fleet, eliminating heavy upfront costs for its customers and bundling services such as monitoring, maintenance, and updates.

While this definition captures some of the economic advantages of RaaS, it misses the mark when it comes to describing the operational flexibility and innovation that modern RaaS companies bring to the table. The robotics ecosystem has evolved, and so must our understanding of what it means to operate as a RaaS company.

The Case for a Refined Definition

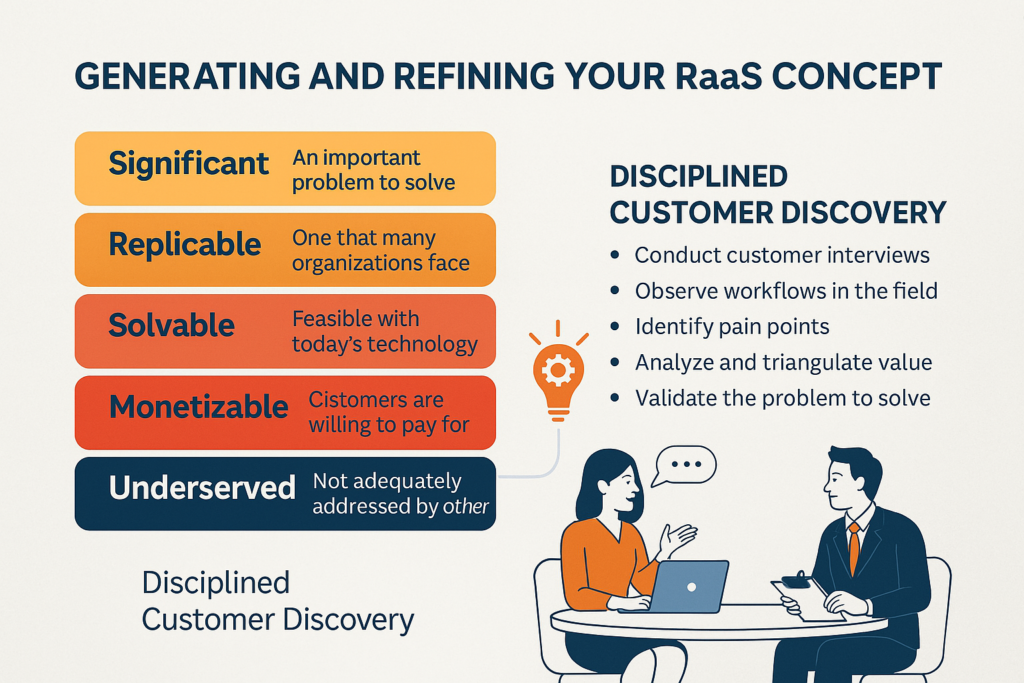

Over the past few years, as an insider in the RaaS ecosystem, and through conversations with stakeholders and analysis of hundreds of companies, I’ve realized that the modern definition of RaaS must go beyond fleet ownership. Instead, it should focus on the key operational and technological features that truly define these companies. These features include:

- Autonomous, Fleet-Centric Service Delivery

- Subscription-Driven Recurring Revenue

- Cloud-Based Backbone

- Scalability as a Path to Profitability

These features collectively redefine what it means to operate as a RaaS company, emphasizing innovation, flexibility, and scalability as the key drivers of success. We now break each of them down.

1. Autonomous, Fleet-Centric Service Delivery:

The core value of RaaS lies in using a robotic fleet to deliver continuous services that address dynamic customer needs with minimal human intervention. These services are typically narrowly focused on a specific use case or class of use cases, providing a targeted solution to a customer problem such as warehouse logistics or autonomous cleaning rather than a general-purpose offering. This focus ensures that the service is optimized to meet particular needs effectively.

Additionally, the autonomy of the fleet is critical for scalability. Autonomous fleets minimize the reliance on human operators, enabling RaaS providers to expand their operations across multiple customer sites without a proportional increase in labor costs.

2. Subscription-Driven Recurring Revenue:

A predictable revenue model based on recurring payments tied to the services provided, whether or not the hardware is owned by the RaaS provider. This subscription model establishes a long-term relationship with the customer, creating opportunities for ongoing engagement and the delivery of continuous value.

The subscription covers access to the software and services necessary to operate, monitor, and maintain the robotic fleet. Some customers do value a subscription model for fleet hardware. However, others prefer outright ownership of their robots while still subscribing to the software and support services. This scenario is sometimes referred to by entrepreneurs as “SaaS for robotic fleets.” I argue that the term Robotics-as-a-Service (RaaS) is sufficient to encompass this arrangement, as it still aligns with the fundamental principles of the model: delivering scalable, subscription-based robotic services that address specific customer needs.

3. Cloud-Based Backbone:

A robust infrastructure that enables the remote monitoring, management, and updating of robotic fleets, ensuring real-time optimization and continuous improvement. From the customer’s perspective, this infrastructure is the primary method by which the RaaS provider delivers value and meets Service Level Agreements (SLAs), guaranteeing consistent performance, uptime, and support.

From the entrepreneur’s perspective, this cloud-based system is a critical enabler of the company’s feedback loop. It allows the provider to track performance metrics and usage patterns, offering valuable insights into how the service is being used. This data is essential for validating business hypotheses, refining the product, and ensuring that the offering continues to meet customer needs effectively. By capturing and analyzing these insights, entrepreneurs can make informed decisions that drive product improvement, enhance operational efficiency, and support the company’s long-term growth and scalability.

4. Scalability as a Path to Profitability:

The ability to grow efficiently across multiple sites and customers without proportional increases in operational costs is a defining feature of RaaS and one of the primary reasons it is particularly attractive to entrepreneurs and investors. Unlike other business models for robotics, where the path to growth is often unclear or difficult to narrow down, RaaS comes with an intrinsic engine of growth. This built-in scalability enables RaaS companies to expand their reach and customer base systematically while maintaining cost efficiency, setting it apart as a compelling and sustainable business model.

That said, while the path to scaling a RaaS company is clearly defined, it is by no means easy. Entrepreneurs must navigate challenges such as operational complexities, customer acquisition, and market differentiation. However, the clarity of the model provides a roadmap for growth that allows companies to focus their efforts on execution rather than conceptualizing how to scale. This combination of a well-defined growth trajectory and cost-efficiency makes RaaS a standout opportunity in the robotics business ecosystem, attracting stakeholders eager to build businesses with predictable revenue and long-term profitability.

Ownership Flexibility: A Key Shift

Under this refined definition, ownership of the robotic fleet is no longer a defining factor of RaaS. Instead, a RaaS company may operate fleets owned by:

- The RaaS provider itself, managing both hardware and services.

- The customer, who uses the provider’s software and services to operate their fleet.

- A third party, enabling flexible financing or leasing arrangements.

For RaaS startups, the ability to shift fleet ownership to customers or third parties is not just an option, it’s often a necessity. Owning an ever-increasing fleet of robots requires allocating a substantial portion of their precious and limited funding to finance hardware assets. This allocation can have a negative ripple effect by shortening the runway of the startup, thereby increasing the risk of failure.

In many cases, corporate customers, often with much deeper pockets than a startup, are both willing and able to absorb the financial burden of the fleet. For these companies, financing operational assets is a routine part of their business practices, covering elements like machinery, vehicles, or IT systems. By allowing customers to own the fleet and pay for the RaaS company’s software and services, entrepreneurs can focus their resources on innovation, scaling, and delivering value, rather than being tied down by hardware financing.

This ownership flexibility allows RaaS companies to adapt to diverse market demands, opening doors for new partnerships, revenue streams, and business models that align with customer needs and financial realities. It also provides a viable path for startups to grow sustainably without being constrained by the significant capital allocation associated with fleet ownership.

Moreover, ownership flexibility extends to the sourcing of the robotic fleet itself. While many RaaS entrepreneurs opt for developing and manufacturing their own custom robots, an alternative approach involves integrating robots developed and manufactured by third parties. This requires the RaaS company to establish strategic partnerships to ensure seamless integration and compatibility. This approach reduces the hardware development burden, enabling the RaaS provider to prioritize scaling their service layer efficiently.

This ownership and sourcing flexibility empowers RaaS companies to innovate and adapt while simultaneously positioning them as agile players in a dynamic market, capable of meeting diverse customer needs and achieving sustainable growth.

Examples Highlighting the Evolving Landscape of RaaS

The refined definition of Robotics-as-a-Service (RaaS) emphasizes flexibility and scalability, going beyond traditional notions of fleet ownership to focus on the operational and technological features that truly define the model. Two companies exemplify how this refined perspective can coexist with diverse approaches to fleet sourcing and management: Locus Robotics and Energy Robotics.

Locus Robotics operates within the traditional concept of RaaS by developing its own custom autonomous mobile robots (AMRs) for warehouse and logistics applications. Their RaaS offering allows customers to reduce the upfront cost of automation by shifting from a capital expenditure (CapEx) model to a subscription-based operational expenditure (OpEx) model. This structure makes automation more accessible and helps businesses achieve a significantly shorter time to ROI. Locus retains full ownership of the robotic fleet, which aligns with the traditional RaaS framework, yet its operational focus and scalable service delivery perfectly embody the elements of the refined definition.

On the other hand, Energy Robotics redefines fleet ownership by integrating an increasing range of third-party robots into their inspection platform. These include robots from manufacturers such as ExRobotics, Boston Dynamics (Spot), ANYbotics, and a variety of drones. Instead of owning or financing the robots, Energy Robotics enables its customers to purchase the hardware directly from the source. The value of their RaaS offering lies in the cloud-based backbone and software platform that allows for remote monitoring, fleet management, and the efficient execution of autonomous inspections across industries such as oil and gas, chemicals, and energy. By removing the burden of hardware ownership while still delivering recurring subscription-based services, Energy Robotics illustrates how the refined RaaS definition can accommodate non-traditional ownership models.

Despite their contrasting approaches to fleet sourcing and ownership, both Locus Robotics and Energy Robotics exemplify the core elements of the refined RaaS definition. They deliver autonomous, fleet-centric services, leverage subscription-driven recurring revenue, utilize a robust cloud-based backbone, and prioritize scalability as a path to profitability.

The Path Forward

By refining the definition of RaaS, we move beyond outdated limitations and embrace the full potential of this transformative business model. A more inclusive and precise understanding of RaaS positions companies to innovate and scale, ensuring they meet the growing demand for flexible, scalable, and efficient robotic solutions.

I’d love to hear your thoughts: Does your robotics business fit this refined definition of RaaS? What opportunities or challenges have you seen in applying these principles? Let’s explore how RaaS will continue to evolve together.

Join the conversation on LinkedIn